Allan Matheson

Oct 17, 2024

“We have not seen, over the centuries, that economies and the public need more than one way to move value.” -US Securities and Exchange Commission, Chair, Gary Gensler June 2023

Innovation in the movement of value sits at the core of blockchain technology. Yet while its purpose is well articulated by regulators, the nature of digital assets themselves remains shrouded in confusion.

This article will seek to determine whether there are opportunities in understanding the paradigm altering nature of the technology, what type of asset class it is and its role in a sophisticated investor’s portfolio.

The Securities and Exchange Commission has stated that the majority of digital assets are securities. The previous commissioner of the Commodities and Futures Trading Commission, Rostin Behnam, on the other hand, stated that Ethereum is a commodity, not a security[1].

Investors, colored by both price appreciation and the prominence of scams, are equally confused. Many appreciate the technological innovation that digital assets represent, but many also view it as so highly speculative that it becomes challenging to find a place for it in a portfolio.

At the root of the issue is the definition of what these assets are, securities, commodities, or something else?

In his seminal work “What is an Asset Class Anyway”, RJ Greer[2] distinguishes asset classes based on one or a combination of the following characteristics; capital assets, consumable or transformable assets, and store-of-value assets. Existing asset classes fit neatly into these categories. Within a portfolio, due to the different characteristics of each, they serve to diversify a portfolio to give steadier, positive returns over time. Then why is there such confusion from investors and regulators with regards to what digital assets actually are.

An equity is an ownership stake in an enterprise. Investing in a commodity is accruing ownership of raw materials, precious metals or primary agricultural materials. So what is a digital asset and how can we define its nature?

Most tokens, especially the ones that are investable and prominent, are either blockchain coins (ex. Bitcoin, Ethereum, Solana) or application tokens (ex. Uniswap, Aave, or Lido). Both of these categories are tokenized ecosystems where code is deployed trustlessly and users engage with the code for a purpose. The code, when used, generates income. When these ecosystems are tokenized, they are not controlled by a company or single entity – most are decentralized, autonomous pieces of code. The token holders govern the code that generates the revenue. So are token holders equity holders? No. They have a direct ownership interest in the code itself and this is one of the innovations that sits at the heart of the asset class. Digital assets are the monetization of code.

Blockchains have two main superpowers, the internet native transfer of value, and smart contracts. These two powers combined are able to provide a direct monetization of the code that is written. In a world that is increasingly digitizing, digital assets will become a key foundation. AI and quantum computing will revolutionize the way industries operate. Digital assets, and the monetization of code, will move from a niche idea to everyday technological interaction. As AIs become ubiquitous, for instance, many of them will use digitally native forms of payment, incentives and provenance. AI cannot open bank accounts. The idea that code itself can be monetized without an intermediary is extremely powerful and dictates blockchain technology’s standing as a new asset class.

Most importantly, the monetization of code as an emerging asset class itself offers sophisticated investors significant alpha. As the asset class gains in prominence, utility, and utilization, the investment in it should increase meaningfully. Unlike securities, investing in productive digital assets offers a unique opportunity to own the infrastructure that the entire technological innovation will be built upon. For instance, visionary investors that recognized the potential of the internet could not own “the internet”. They needed to buy equity interests in the companies of the day, most of which are no longer in existence. However, with digital assets, owning Bitcoin, Ethereum, Solana, etc. offer the opportunity to own the mediums upon which the technology itself will be built upon and thrive. In this way, digital assets are a very unique asset class.

It must be noted that the birth of a new asset class is extremely rare! See the chart below.

Asset Class | Birth Date |

Equities[3a] | The Dutch East India company is the first to issue equity to the public in 1602. [3b] |

Fixed Income[4] | First sovereign bond in modern history issued by the Bank of England in 1693. |

Commodities | Commodities markets go back millennia. The first modern futures exchange is probably the Dojima Rice Exchange, founded in 1710. [5] |

Real Estate | Property is as old as time. Modern Real Estate Investment Trusts began in the USA in 1961 with the American Realty Trust. [6] |

Cash and Cash Equivalents | Uhm. Very old. And lets not open the can of worms titled, “what actually is money”. This isn’t that type of article. |

Alternative Investments | The first “hedge fund” was probably the Graham-Newman Partnership which was formed in 1926 |

See here how reallocation to digital assets

could be contemplated in a family office portfolio.

A new asset class emerging, especially one which offers direct participation in the digitization of society is in itself investment alpha. Adding to the unique nature of digital assets is that this asset class, because of its inability to fit into a regulator’s strict definition, has grown in a grassroots manner. Institutions are still unable or unwilling to take exposure.

Within this asset class there are also two categories. Bitcoin (BTC), the first digital asset and the largest, is distinct as it functions as a store-of-value. All other major blockchain coins and application tokens are investments in code which fulfills a function. In the charts below, we track Bitcoin and Total 2, the value of tokens that are not Bitcoin. While Bitcoin may eventually sit alongside gold as a premier store-of-value asset, blockchain coins and application tokens represent a play on the technology of smart contracts. It is worth reviewing data for both of these subsets separately. Over time, perhaps decades, they are likely to diverge greatly as they have exceedingly different use cases.

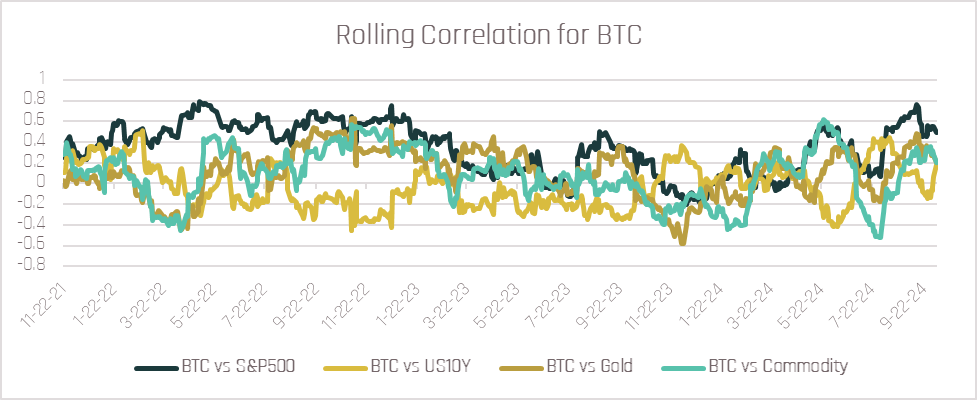

Sophisticated investors will ask themselves how this investment could fit in their current portfolio. If digital assets are truly a different asset class then they should be uncorrelated to other major asset classes and should play a key diversification role. When compared to other select asset classes below, it is notable that no asset class is significantly correlated to either Bitcoin or all other digital assets (TOTAL2).

By simply looking at correlation averages over a three year period, it can be seen that both Bitcoin and all other digital assets remain relatively uncorrelated. See below graphic.

Furthermore, one can see the affect of adding Bitcoin to a traditional 60/40 portfolio increases returns meaningfully. When adding smart contract technology, the difference is even larger, suggesting that the potential of adding the asset class extends along the tail of assets towards code that breeds greater technological disruption.

Truly investors are living in a time of significant innovation and change, witnessing the advent of powerful new technologies and new asset classes. As technologies like AI and quantum computing combine to replace the way that society and industry operate, blockchains will provide important technological foundations. The ability to monetize code, although currently difficult to understand, will eventually be one of the bedrocks of the digitization of society and due to the unique nature of the digital asset class, provide generous opportunities to benefit from being on this important frontier.

Allan Matheson is the founder of Golden Pear Capital, a crypto asset-focused investment management company.

Disclaimer:

This article is for general informational purposes only. Any commentary and information contained in this article should not be considered as financial or investment advice, and is not intended to provide legal, accounting, or tax advice. This article may contain the opinions, views or recommendations of individuals or organizations. These opinions and views are provided for your general interest only and are not endorsed by Golden Pear Capital Ltd., Golden Pear Digital (BVI) Ltd. or affiliates, from hereon, referred to as "Golden Pear". Every effort has been made to ensure that the material contained in this article is accurate at the time of publication. However, Golden Pear cannot guarantee its accuracy or completeness and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein. Facts and data provided by Golden Pear and other sources are believed to be reliable when posted. Golden Pear cannot guarantee that they are accurate or complete or that they will be current at all times. Any information, including performance data available through any third party provider is not guaranteed to be current, accurate or complete and is subject to change without notice. Performance data represents past performance and is not indicative of future performance. There may be inherent conflicts of interest included in the article as a result of the Golden Pear involvement in the digital asset industry.

Sources:

[1] https://finance.yahoo.com/news/cftc-chair-calls-ethereum-commodity-111551034.html

[2] https://www.pm-research.com/content/iijpormgmt/23/2/86

[3a] https://www.beursgeschiedenis.nl/en/the-story/

[3b] https://www.investopedia.com/ask/answers/08/first-company-issue-stock-dutch-east-india.asp#citation-8

[4] https://en.wikipedia.org/wiki/Bond_market

[5]https://en.wikipedia.org/wiki/Futures_exchange#:~:text=The%20first%20modern%20organized%20futures,of%20the%20Royal%20Exchange%2C%20London.

[6] https://en.wikipedia.org/wiki/Real_estate_investment_trust#:~:text=The%20first%20REIT%20was%20American,the%20world%20have%20established%20REITs.

Data sources for all above charts:

S&P 500 data: Yahoo Finance, https://finance.yahoo.com/

US 10-Year Treasury Bond Yield: Yahoo Finance, https://finance.yahoo.com/

Cryptocurrency data (BTC): Binance, https://www.binance.com/

Cryptocurrency Data (Total2): TradingView, https://www.tradingview.com/

Gold price data (using GLD ETF): Yahoo Finance, https://finance.yahoo.com/

Bloomberg Commodity Index: Yahoo Finance, https://finance.yahoo.com/