Allan Matheson

Feb 21, 2024

The approval of spot Bitcoin ETF's in the United States seems to have launched a renewed interest in digital asset investments. Not only do these new ETF’s provide a new, safer wrapper, but they also vastly extend the accessibility of these investments to otherwise more risk averse institutional investors.

The presence of these options seems to have kicked off a flurry of discussions about how to navigate a completely new asset class within a portfolio. Mapping this out can be complex but for once it seems as though sophisticated investors are asking themselves where digital assets fit within their portfolio construction, not as a result of irrational exuberance in the market, but because the availability of product which suits their risk appetites has changed meaningfully.

Is the asset class investable and how should these investments be structured within a modern portfolio? Typically, all except the most savvy crypto investors tend to have an overly simplistic view of investing in digital assets. The delineation between the form and characteristics of different crypto investment vehicles can take a back seat to a more binary approach. The truth is that there are a wide variety of different ways to invest in crypto, each with their own opportunities drawbacks and risks. For family offices and sophisticated allocators, blending these options will usually result in the best outcome.

So what options exist? First one must make a decision as to how much control and therefore risk one would like to take when investing. The foundations of crypto were built upon self-custody, that is, assets are under your own control and there are no intermediaries. Of course, this is a liberating concept, however it comes with significant risks especially for those who are deploying significant assets. Securing those assets under a self-custody model needs professional design and oversight and thusly those who cannot make the commitment both financially and operationally to these security requirements should consider using a more secure structure.

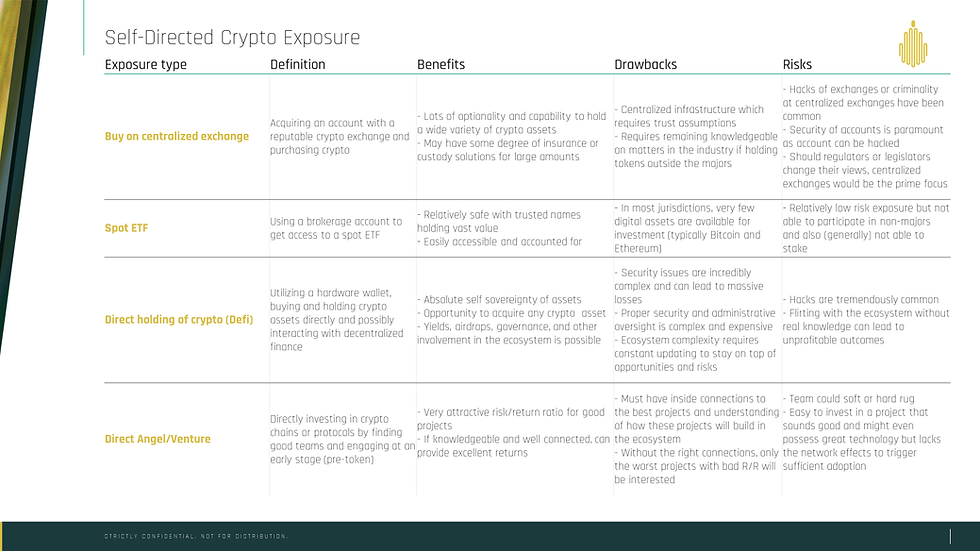

The primary form of investments in the self-custody category are as follows:

Clearly the risks associated with most of these options should be borne knowingly and only in the most unique circumstances. Catastrophic loss of assets is not uncommon in crypto and as such, for professional investors, guarding against this outcome is paramount. As a result, for the purposes of the above options, only the ETF (and possibly a secure, trustworthy exchange, if available) should be considered.

Instead, funds can offer the trust, care and attention that can help minimize security risks and provide access to opportunities that large investors are seeking. See the below chart showing the different categories of funds that are available.

Some of the above funds offer better opportunities than others. At the core of choosing a fund, should be a match between what the investor is trying to accomplish or express, vs. what the fund is offering. For the purposes of this article, lets assume that investors in digital assets believe in the technology and that it has an opportunity to become the next iteration of the internet. With that assumption made, there are several forms of fund that will not properly fit. For instance, although crypto absolute return funds may offer some attractive returns, an absolute return fund is almost agnostic to the long-term prospects of the technology. If one wants absolute returns, the venue for applying those strategies should be secondary and if one identifies a crypto absolute return fund with attractive performance, it should probably be considered as an alternative to non-crypto absolute return funds.

However, both crypto venture and liquid token funds, combined, tend to offer different opportunities at different parts of the cycle, not dissimilar to other asset classes. Therefore, identifying well run crypto venture funds, managed by veterans who can both position around the development of the technology and get access to the best teams of builders should be a part of the strategy. However, at some point, venture funds wind down and sell their positions which means that these funds concentrate on the early stages of crypto enterprises and do not provide exposure to longer term holdings that may see value continue to accrue to foundational projects. Liquid token funds, especially ones that are able to provide further returns by utilizing the technology they are investing in, can offer longer term investment opportunities that will end up owning the “FAANGS” of tomorrow.

As for NFT Funds, these have fallen out of favour as the NFT market has endured its own winter. For family offices that have allocation to art and antiques, NFT funds could be interesting. However, at the moment, NFTs are highly illiquid, volatile and extremely challenging to navigate, even by seasoned professionals.

Once the best fund options have been identified, it makes sense to consider allocation. What part of an investor’s portfolio should be allocated to crypto? Of course, that is dependent on conviction, risk appetite and timing vis-à-vis the market and other opportunities. However, rather than simply allotting X% of a portfolio, and again under the assumption that the investor believes crypto is a revolutionary technology, perhaps it is more intuitive to consider expressing that conviction by partitioning a percentage of each traditional basket of investment. Taking the UBS Global Family Office Report 2023 allocations as the starting point, a version of that could be as follows:

Of course quite a few assumptions are built in to this model. However, it may illuminate a more nuanced view of how to express confidence in the technology. By maintaining long exposure and using different vehicles to not only express conviction, but also to get access to the best opportunities and security, one can minimize administrative requirements and increase exposure in the most comprehensive manner. Mapping exposure to a new asset class can be a challenge but being thoughtful about how to navigate these uncharted waters can yield the most fruitful discoveries with the least amount of risk and pain.

Allan Matheson is the founder of Golden Pear Capital, a crypto asset-focused investment management company.

Disclaimer:

This article is for general informational purposes only. Any commentary and information contained in this article should not be considered as financial or investment advice, and is not intended to provide legal, accounting, or tax advice. This article may contain the opinions, views or recommendations of individuals or organizations. These opinions and views are provided for your general interest only and are not endorsed by Golden Pear Capital Ltd., Golden Pear Digital (BVI) Ltd. or affiliates, from hereon, referred to as "Golden Pear". Every effort has been made to ensure that the material contained in this article is accurate at the time of publication. However, Golden Pear cannot guarantee its accuracy or completeness and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein. Facts and data provided by Golden Pear and other sources are believed to be reliable when posted. Golden Pear cannot guarantee that they are accurate or complete or that they will be current at all times. Any information, including performance data available through any third party provider is not guaranteed to be current, accurate or complete and is subject to change without notice. Performance data represents past performance and is not indicative of future performance. There may be inherent conflicts of interest included in the article as a result of the Golden Pear involvement in the digital asset industry.